2024 Missouri Income Tax Rate. The missouri state tax calculator (mos tax calculator) uses the latest federal tax tables and state tax tables for 2024/25. A financial advisor in missouri can help you understand how taxes fit into your overall financial goals.

Effective january 1, 2024, missouri’s department of revenue reduced its top individual income tax rate from 4.95 percent to 4.8 percent as the respective revenue triggers. The missouri state tax calculator (mos tax calculator) uses the latest federal tax tables and state tax tables for 2024/25.

The Income Tax Rate For The Current Tax Year Is 4.8%.

Like the federal income tax, the missouri state income tax is progressive, meaning the rate of taxation increases as taxable income increases.

If The Same Single Filer Lives In St.

Louis must also pay a 1% earnings tax, which will.

Missouri Has A Progressive Tax Income Structure, Meaning The Tax Rate Changes Based On The Amount You Earn.

Images References :

Source: constantinawrory.pages.dev

Source: constantinawrory.pages.dev

Mo Tax Rate 2024 Suzi Zonnya, But missouri’s sales tax is higher compared to other. Like the federal income tax, the missouri state income tax is progressive, meaning the rate of taxation increases as taxable income increases.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Like the federal income tax, the missouri state income tax is progressive, meaning the rate of taxation increases as taxable income increases. This rate is reduced to 4.8% for 2024.

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg) Source: www.investopedia.com

Source: www.investopedia.com

State Tax vs. Federal Tax What's the Difference?, Missouri state income tax calculation: Welcome to the 2024 income tax calculator for missouri which allows you to calculate income tax due, the effective tax rate and the.

Source: camilleoauria.pages.dev

Source: camilleoauria.pages.dev

Ca State Tax Brackets 2024 Bobbi Chrissy, To estimate your tax return for 2024/25, please select. Missouri residents state income tax tables for married (joint) filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

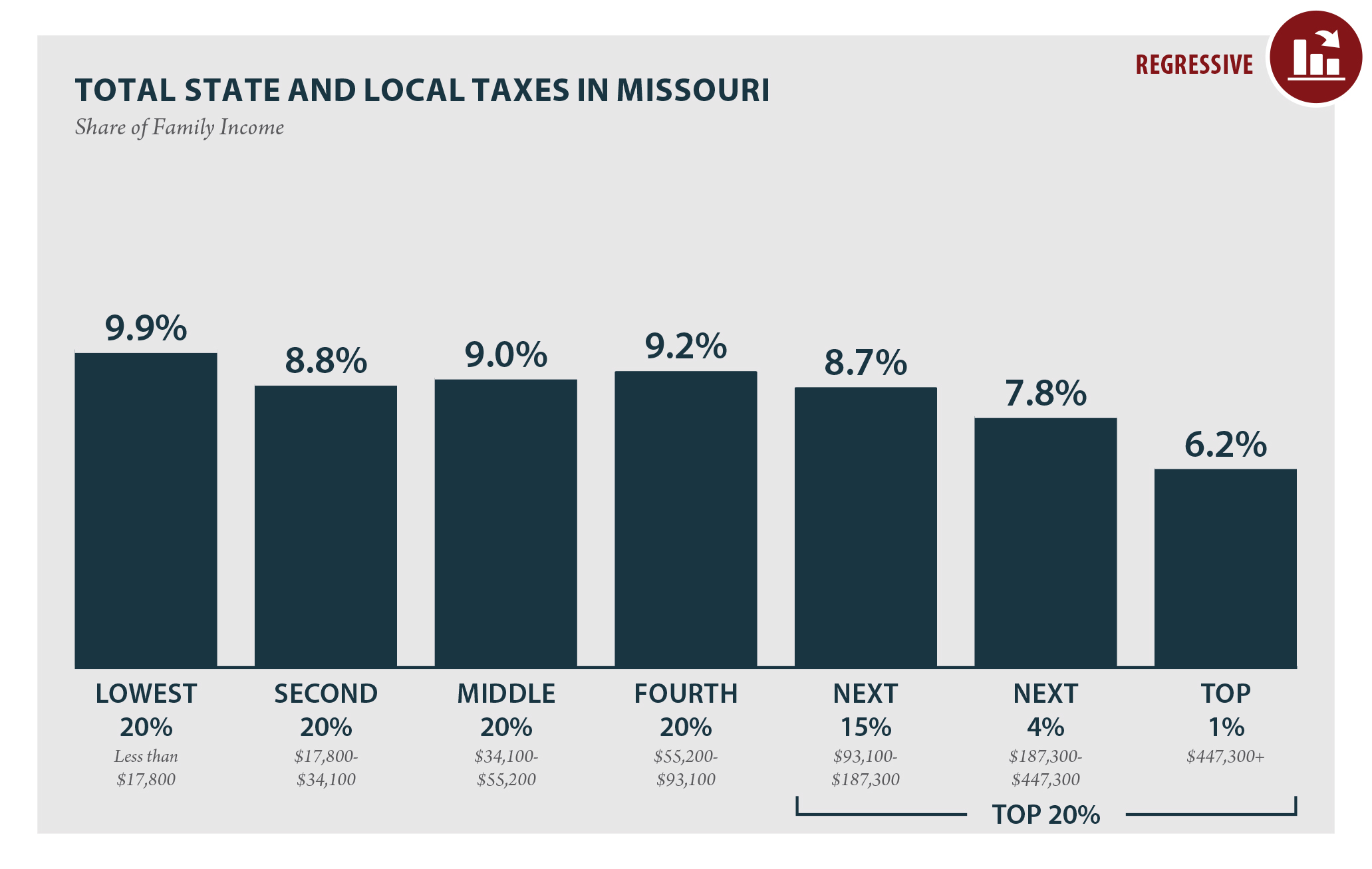

Source: itep.org

Source: itep.org

Missouri Who Pays? 6th Edition ITEP, In the calendar year 2024, the top tax rate may be further reduced by about 0.15% from 2023’s tax rate to 4.8%. The income tax rates for the 2023 tax year (which you file in 2024) range from 0% to 4.95%.

Source: calendar.cholonautas.edu.pe

Source: calendar.cholonautas.edu.pe

Tax Rates 2023 To 2024 2023 Printable Calendar, Updated for 2024 with income tax and social security deductables. Missouri has a progressive tax income structure, meaning the tax rate changes based on the amount you earn.

.png) Source: taxfoundation.org

Source: taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates, Residents of and people who work in kansas city or st. Income tax rate reductions in 2024.

Source: taxp.blogspot.com

Source: taxp.blogspot.com

Missouri Tax Refund Calendar 2020 TAXP, If the same single filer lives in st. The income tax rate for the current tax year is 4.8%.

Missouri Tax Tables 2024 Kelsi Melitta, Here are the current missouri tax brackets posted by the missouri department of revenue : But missouri’s sales tax is higher compared to other.

Source: www.dochub.com

Source: www.dochub.com

Missouri state tax Fill out & sign online DocHub, That means that your net pay will be $43,881 per year, or $3,657 per month. Updated on apr 24 2024.

Louis Must Also Pay A 1% Earnings Tax, Which Will.

Here are the current missouri tax brackets posted by the missouri department of revenue :

Missouri Income Tax Calculator 2024.

As your income goes up, the tax rate on the next layer of income is higher.