Roth Ira Income 2024. For more information about these transfers, see converting. Here's a rundown of the 2023 and 2024 roth ira income and contribution limits, based on your filing status and modified adjusted.

Best gold iras best investments for a roth ira best bitcoin iras protecting your 401(k) in a recession types of iras roth vs traditional ira how to open a roth. Roth ira contribution limits for 2024.

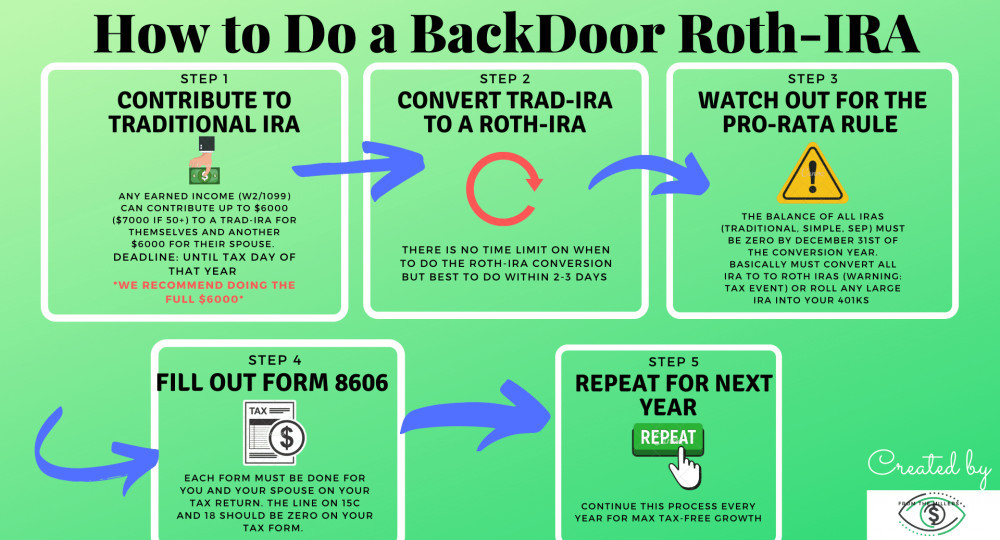

High Earners Can Go The Backdoor Roth Ira Route To Take Advantage Of The Account's Benefits.

*if you and your spouse didn't live together during the taxable year, your filing status will be viewed as single for roth ira contribution.

For Starters, If The Only Way You Can Pay The Taxes Due On.

If you are part of a married couple filing jointly or a qualifying widow or widower with modified adjusted gross income of under $230,000, you can save the.

For 2023, The Roth Ira Contribution Limit Is $6,500, Which Is The Same Amount As The Traditional Ira Limit.

Images References :

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png) Source: www.investopedia.com

Source: www.investopedia.com

Savings Account vs. Roth IRA What’s the Difference?, Your ability to contribute to a roth ira and the amount. For more information about these transfers, see converting.

Source: personalfinancewellness.com

Source: personalfinancewellness.com

What Is A Backdoor Roth IRA? How Does It Work In 2021? Personal, Amount of roth ira contributions that you can make for 2023. While the benefits of a roth ira are hard to ignore, it’s not always a good idea to convert a traditional ira to a roth ira.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS announced its Roth IRA limits for 2022 Personal, The roth ira income limit refers to the amount of money you can earn in income before the roth ira maximum annual contribution begins to phase down. Eligibility to contribute to a roth ira also depends on your overall income.

Source: due.com

Source: due.com

Backdoor Roth IRA's, What You Should Know Before You Convert Due, For more information about these transfers, see converting. Your ability to contribute to a roth ira and the amount.

Source: www.carboncollective.co

Source: www.carboncollective.co

Roth IRA vs. 401(k) A Side by Side Comparison, Credit cards view all credit cards And if you don’t have a retirement plan at work, you may still be able to use a roth ira to invest for the future.

Source: themilitarywallet.com

Source: themilitarywallet.com

2024 Traditional and Roth IRA and Contribution Limits, For more information about these transfers, see converting. The irs sets income limits that restrict high earners.

Source: priscawelana.pages.dev

Source: priscawelana.pages.dev

Acp Limits For 2024 Addie Anstice, The roth ira income limit refers to the amount of money you can earn in income before the roth ira maximum annual contribution begins to phase down. If you’re 50 or older, you can contribute up to $1,000.

Source: www.elementforex.com

Source: www.elementforex.com

IRA Contribution Limits And Limits For 2023 And 2024 Forex, This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose. The irs sets income limits that restrict high earners.

Source: www.fi3advisors.com

Source: www.fi3advisors.com

Traditional vs. Roth IRAs What's the Difference? — Fi3 Advisors, Here's a rundown of the 2023 and 2024 roth ira income and contribution limits, based on your filing status and modified adjusted. Your ability to contribute to a roth ira and the amount.

Source: yourfinancialpharmacist.com

Source: yourfinancialpharmacist.com

Why Most Pharmacists Should Do a Backdoor Roth IRA, If you’re 50 or older, you can contribute up to $1,000. Eligibility to contribute to a roth ira also depends on your overall income.

Your Roth Ira Contribution Might Be Limited Based On Your Filing Status And Income.

The roth ira income limits are $161,000 for single tax filers.

Amount Of Roth Ira Contributions That You Can Make For 2023.

For 2023, the roth ira contribution limit is $6,500, which is the same amount as the traditional ira limit.