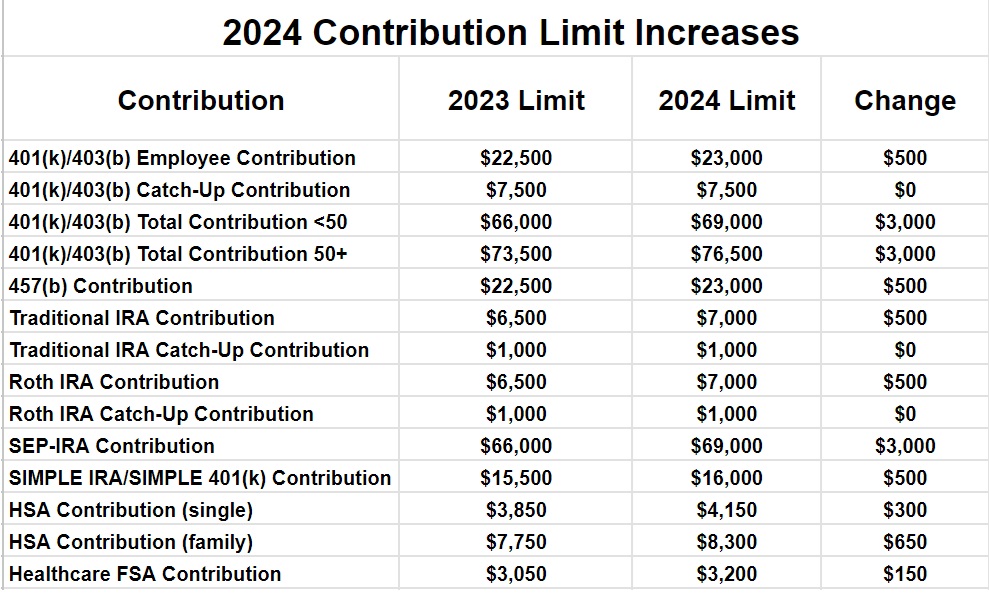

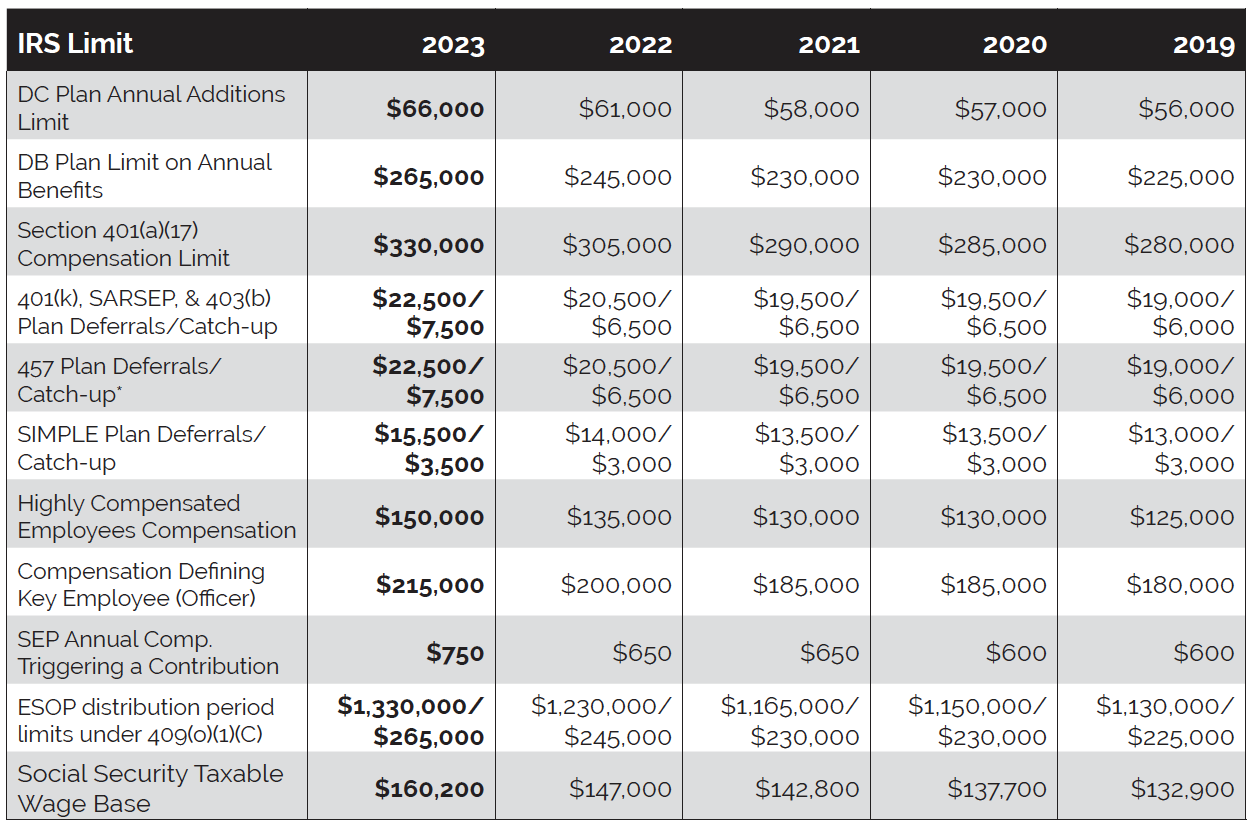

Retirement Contribution Limits For 2024. 457 contribution limits for 2024 the maximum amount you can contribute to a 457 retirement plan in 2024 is $23,000, including any employer contributions. 457 (b), 403 (b), and thrift savings plans.

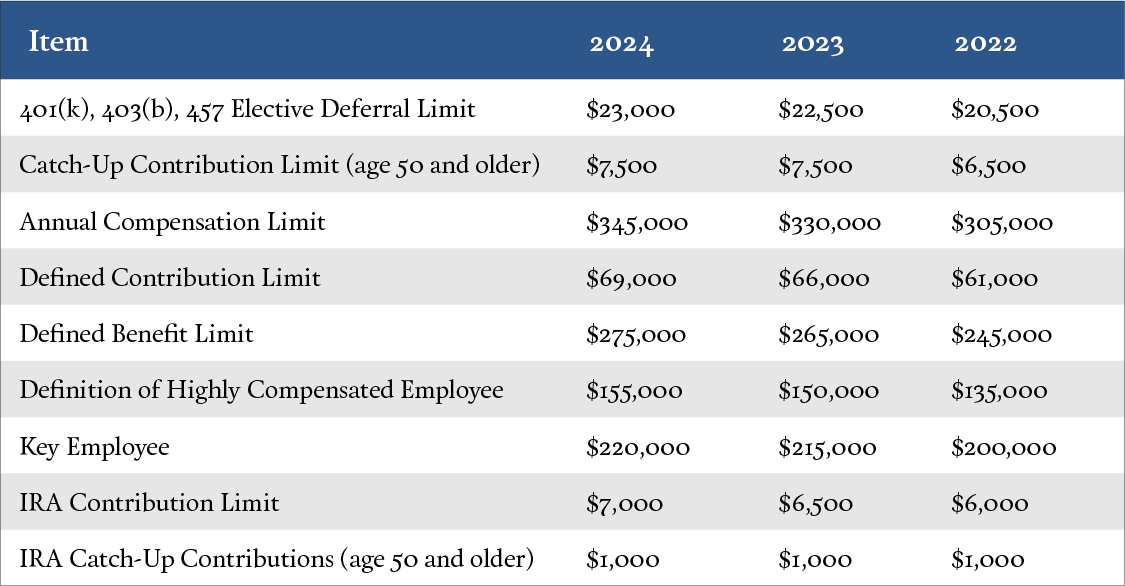

The total contribution limit for 401 (a) defined contribution plans under section 415 (c) (1) (a) increased from $66,000 to $69,000 for 2024. The combined annual contribution limit for roth and traditional iras for the 2024 tax year is $7,000, or $8,000 if you’re age 50 or older.

This Amount Is Up Modestly From 2023, When The Individual.

Defined benefit plan benefit limits;

Contribution Limits For 401(K)S, 403(B)S, Most 457 Plans, Thrift Savings Plans (Tsps), And Other Qualified Retirement Plans Rise Were $23,000 For 2024, Rising From.

The 2023 401 (k) contribution limit for employees was $22,500.

For 2024, Employees May Contribute Up To $23,000.

Images References :

Source: meggiqalbertine.pages.dev

Source: meggiqalbertine.pages.dev

Roth Ira Contribution Limits 2024 Eilis Harlene, This includes both employer and employee. The combined annual contribution limit for roth and traditional iras for the 2024 tax year is $7,000, or $8,000 if you're age 50 or older.

Source: capstoneinvest.com

Source: capstoneinvest.com

2024 Retirement Plan Updates from IRS Financial AdvisorRetirement, For 2024, employees may contribute up to $23,000. If these limits increase in 2024, it may require adjustments to your retirement plan.

What’s New for Retirement Saving for 2024? SEIA Signature Estate, For 2024, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. This amount is up modestly from 2023, when the individual.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, Contribution limits for 401(k)s, 403(b)s, most 457 plans, thrift savings plans (tsps), and other qualified retirement plans rise were $23,000 for 2024, rising from. 2024 retirement plan contribution limits.

Source: rositawcarena.pages.dev

Source: rositawcarena.pages.dev

457 Catch Up For 2024 Gaby Pansie, Retirement plans offered through your employer can either be defined benefit plans, such as a pension, or defined contribution plans, like a 403 (b), 457 or 401. 457 contribution limits for 2024 the maximum amount you can contribute to a 457 retirement plan in 2024 is $23,000, including any employer contributions.

Source: simonnewblake.pages.dev

Source: simonnewblake.pages.dev

Irs Limits For 2024 Melva Sosanna, This amount is up modestly from 2023, when the individual. For 2024, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

Source: www.linkedin.com

Source: www.linkedin.com

Unlock Your Financial Future A Quick Guide to 2024's IRA and, Retirement contribution limits are an important aspect of planning for your future. If your employer offers a.

Source: sandboxfp.com

Source: sandboxfp.com

2024 Contribution Limits for Retirement Plans — Sandbox Financial Partners, 2024 traditional and roth ira contribution limits. For 2023, the total contributions you make each year to all of your.

Source: www.midlandsb.com

Source: www.midlandsb.com

Plan Sponsor Update 2023 Retirement Plan Limits Midland States Bank, 401 (k) pretax limit increases to $23,000. This includes both employer and employee.

Source: socialk.com

Source: socialk.com

Annual Retirement Plan Contribution Limits For 2023 Social(K), 457 (b), 403 (b), and thrift savings plans. The combined annual contribution limit for roth and traditional iras for the 2024 tax year is $7,000, or $8,000 if you're age 50 or older.

Get A Quick Summary Of The 2024 Retirement Contribution Plan Limits For Plans Like 401(K)S, 403(B)S, 457(B)S, Iras, And More.

Irs releases the qualified retirement plan limitations for 2024:

The Dollar Limitations For Retirement Plans And Certain Other Dollar Limitations.

Contribution limits for 401(k)s, 403(b)s, most 457 plans, thrift savings plans (tsps), and other qualified retirement plans rise were $23,000 for 2024, rising from.